Raising capital usually means spending 5-10 hours every week on investor outreach that goes nowhere. You're crafting personalized emails, tracking conversations in spreadsheets, and hoping someone responds. The result is response rates under 1% and a fundraising process that feels like a waste of time.

Iceberg changes that completely by connecting founders with the right investors at the right time. The platform has already helped founders raise over $20M in the past year, with response rates hitting 32% when following the recommended approach. Even better, the time commitment drops to just 2.5 hours per week.

Keep reading to learn how Iceberg can help you raise capital more efficiently.

Key Features

After signing up you describe your raise, and within minutes you're looking at matched investors. Here's what the platform offers:

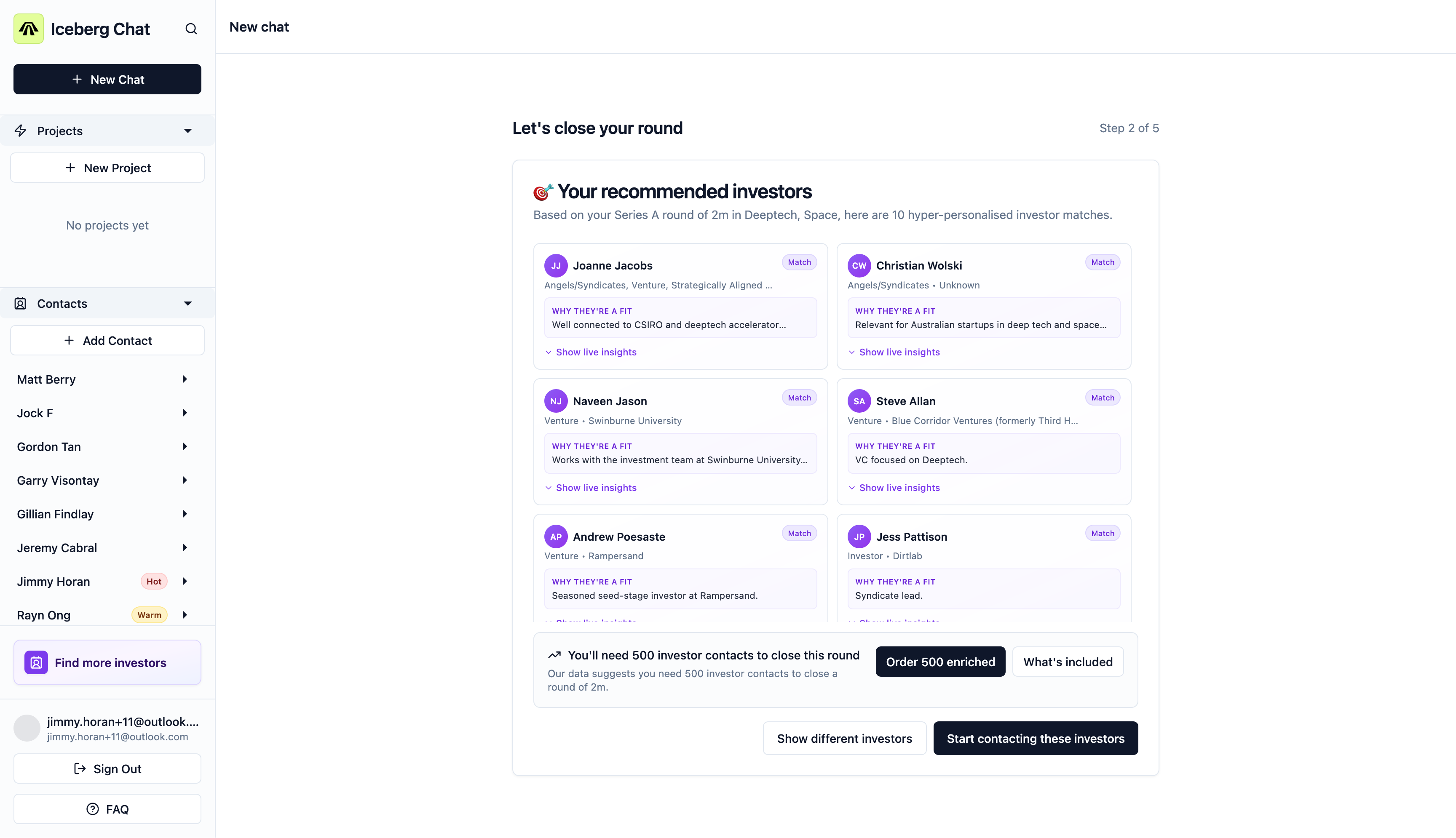

5-Step Fundraising Flow. The platform guides you through a structured process: describe your raise, get hyper-personalized investor matches, generate customized email templates, set accountability check-ins, and scale your outreach. The whole system keeps you moving forward without getting stuck in analysis paralysis.

Smart Investor Matching. Instead of generic contact lists, Iceberg shows you why each investor is a good fit - their investment focus, investment range, live insights, and match reasoning. The platform adjusts recommendations based on how many other founders have already contacted each investor, helping you avoid saturated contacts.

AI-Generated Email Templates. The platform creates personalized outreach emails based on over 3,000 investor engagements. You get three template types: Get a Meeting, Traction Positioning, and Big News Update.

Live Investor Insights. The platform tracks investor sentiment and behavior across their network, surfacing contextual insights such as investor sentiment on market trends. It's not just contact information - it's intelligence about what investors are actually interested in right now.

Network Effect Intelligence. Every founder using the platform contributes to making it smarter for everyone else. The more founders interact with the system, the better it becomes at identifying which investors are most likely to respond.

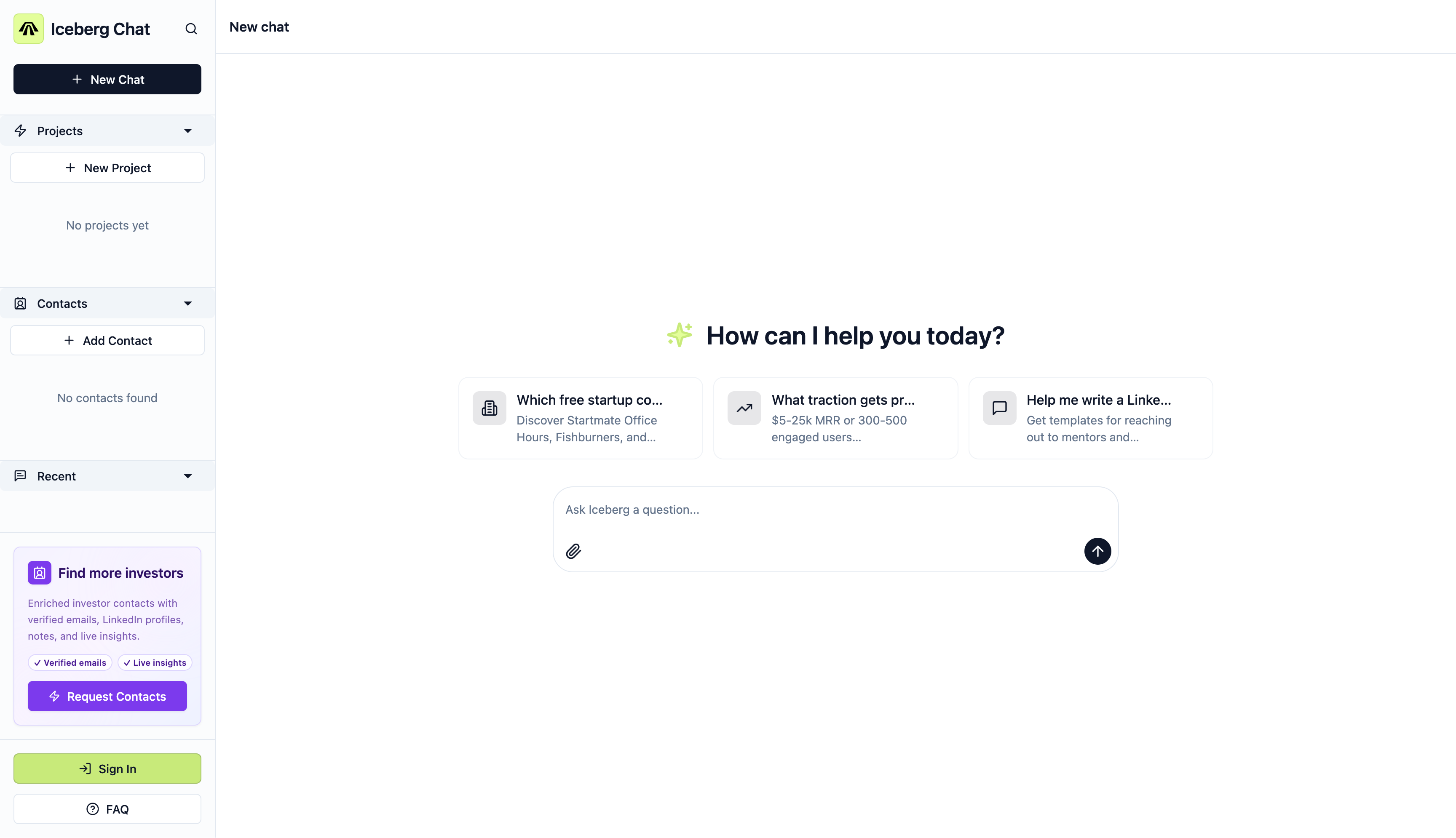

AI Chat Assistant. You can ask the assistant any fundraising question you may have. From early-stage questions like "what should I include in my pitch deck?" to seed-stage due diligence questions, the assistant provides relevant advice.

Who Should Use This

Iceberg works best for founders who have raised some capital before, or are at least 6-9 months out from a raise. That said, anyone is welcome to use the platform - the AI assistant can guide founders at any stage.

Founders who prefer data-driven decision making will appreciate the platform's approach - you're not guessing which investors to contact, you're following recommendations based on actual response patterns and investor behavior.

Plans

Iceberg offers a generous free tier with 10 enriched investor contacts. You get the full platform experience - AI chat, continuous investor recommendations, personalized messaging, and a complete CMS for managing your outreach pipeline from scouting through feedback. The free tier is perpetual with no time limit (for now).

The generous free tier is part of their co-creation phase, where they're using founder feedback to improve the product. Their mission is to "create transparency across the private investment ecosystem to help the right money land in the right places."

When you're ready to scale, you can order additional enriched contacts.

Keep in Mind

Some key workflows are still manual: email management (you'll copy emails from Iceberg into your email client), raise preparation (creating pitch materials), and closing (finalizing investments). All are on the roadmap.

The free tier includes 10 contacts, which validates the platform's effectiveness but you'll likely want more for a full campaign. For a $2M seed round, plan for around 500 contacts.

Final Verdict

Rating: 4.8/5

Iceberg delivers exactly what founders struggling with investor outreach need: smarter targeting, proven templates, and massive time savings. The network effect is the real differentiator - every founder's interaction makes the recommendations better for everyone else.

Even investors endorse the approach. Ben Crow, Head of Ventures at VentureCrowd, notes: "The work Iceberg [does] preparing founders networks to be primed for capital is exactly the strategy and work that needs to be done for successful capital raises." Email integration would make it more seamless, but copy-pasting is a minor friction compared to the hours saved.

For founders looking to raise efficiently, the combination of AI matching and real investor intelligence removes most of the guesswork. With a generous free tier and results that speak for themselves (32% response rates, $20M raised), there's little reason not to try it.